Platform engineering has always been about building golden paths—clear, repeatable routes that help developers move faster, safer, and with less cognitive overload. But here’s the challenge: how do you know which platforms, tools, and vendors should be part of those golden paths? For years, that decision has been shaped by static analyst reports, vendor marketing, and (let’s be honest) a fair amount of guesswork.

Today, that changes. Futurum Signal is live.

And unlike anything before it, Futurum Signal is a real-time, AI-powered market intelligence platform designed to help platform teams cut through the noise, see where vendors actually stand, and make smarter decisions about which platforms to invest in.

Why Platform Engineers Should Care

If you’re building an internal developer platform, every choice matters. Pick the wrong CI/CD system, and you frustrate developers. Choose the wrong observability or security tool, and your platform becomes a bottleneck instead of an enabler. The problem isn’t lack of options—it’s too many. The DevOps and platform tooling space has become overcrowded, with dozens of vendors claiming leadership in every category.

Futurum Signal tackles that problem head-on. Instead of static PDFs and once-a-year “magic quadrants,” Signal is continuously updated, blending three streams of intelligence:

- Millions of peer reviews from G2—real feedback from real practitioners.

- Agentic AI collection and verification of public data—websites, reports, news, and more, correlated and cleaned in real time.

- Futurum analyst expertise—validating, contextualizing, and adding insights drawn from decades of industry experience and ongoing vendor conversations.

Put it together and you get a living system that reflects the market as it is—not as it was six months ago when someone closed out a survey.

Inside Futurum Signal

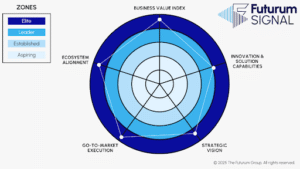

One of the most compelling aspects of Futurum Signal is how it visualizes the market.

The Radar View maps vendors across five critical dimensions: Business Value Index, Innovation & Solution Capabilities, Strategic Vision, Go-to-Market Execution, and Ecosystem Alignment. Vendors are then grouped into zones: Aspiring, Established, Leader, or Elite. That means platform engineers can instantly see where a tool shines (maybe innovation) and where it lags (perhaps execution).

The Vendor Comparison Bubble uses concentric rings to show vendor maturity at a glance—a quick way to distinguish the truly Elite players from those still climbing the ladder.

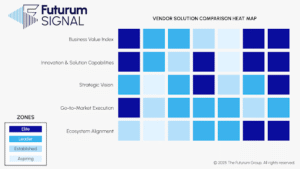

And the Heat Map View provides a side-by-side fingerprint of vendor performance across categories. For a platform team weighing multiple observability vendors or deciding between security toolchains, this kind of comparative clarity is invaluable.

Instead of piecing together slides from three vendors and a six-month-old analyst report, Futurum Signal gives you a fresh, multidimensional look at the market in real time.

Today’s Launch: Data Intelligence Platforms

Futurum Signal launches today with its first solution area: Data Intelligence Platforms. This is the right place to start. Data isn’t just a pillar of modern IT—for platform engineers, it’s the connective tissue between systems, pipelines, and experiences. Whether it’s telemetry driving observability or data streams fueling AI, platforms live and die by how well they manage data.

In the coming weeks, Futurum Signal will expand to cover Security Operations Platforms, Software Engineering Platforms, Agentic AI Platforms, AI Cloud Platforms, Sales/Service/Marketing Platforms, and Cloud Marketplace Platforms. The roadmap may evolve, but the vision is consistent: continuous clarity for every layer of the modern platform stack.

What the Market is Asking

Since announcing Futurum Signal last week, I’ve spoken with both vendors and practitioners. The enthusiasm is real, but so are the questions. Three keep surfacing:

Q1: How do you collect the data?

Through the three-legged stool I mentioned earlier: G2 reviews, agentic AI harvesting and verifying public data, and Futurum’s own analyst insights. It’s broader, deeper, and fresher than anything else out there.

Q2: How do I access the data?

Subscribers get continuous access by solution area. Vendors will license Futurum Signal data to power their strategies (and many will share this with customers). Futurum will also publish periodic executive summaries for public access.

Q3: Can vendors influence the findings?

Nope. This isn’t your grandfather’s analyst report. You can’t wine-and-dine your way to the “top right.” Futurum Signal is immune to that kind of influence because it’s anchored in practitioner data and verified public sources. If you want to rank higher, you have to perform better in the market. Period.

What This Means for Platform Engineering

For platform engineers, Futurum Signal is more than another research tool—it’s a compass. It helps you navigate an increasingly complex vendor landscape with real data, not just hype. It helps you design golden paths based on reality, not on who shouted the loudest at the last conference. And it helps your teams move faster by reducing the risk of picking the wrong vendor for your platform.

Futurum Signal isn’t perfect, and it will evolve. But that’s the point: like the platforms you build, it’s a living system that adapts to its users and the world around it.

At some point, you have to stop tinkering and let your creation fly. For Futurum Signal, that moment is today. And for platform engineers, it couldn’t come at a better time.